If you choose the second choice, you can get into what’s known as an enthusiastic escrow contract that have your mortgage lender

最后更新于:2024-09-27 06:14:19

A lot of expenditures include to order property. About three of the large of those? Assets taxes, homeowners insurance and you may, for many customers, personal home loan insurance. Purchasing such costs normally need people in order to create $8,100000, $nine,one hundred thousand or higher than just $12,one hundred thousand per year, based on where they live.

So that the question is: Do you really trust yourself to save up the bucks making these types of money your self? Otherwise is it possible you favour your own mortgage lender collect the cash to fund your own insurance coverage and income tax expense per month and you will then make new costs in your stead?

You are able to shell out $500 per month to pay for this type of taxation, currency that financial have a tendency to put towards a keen escrow account

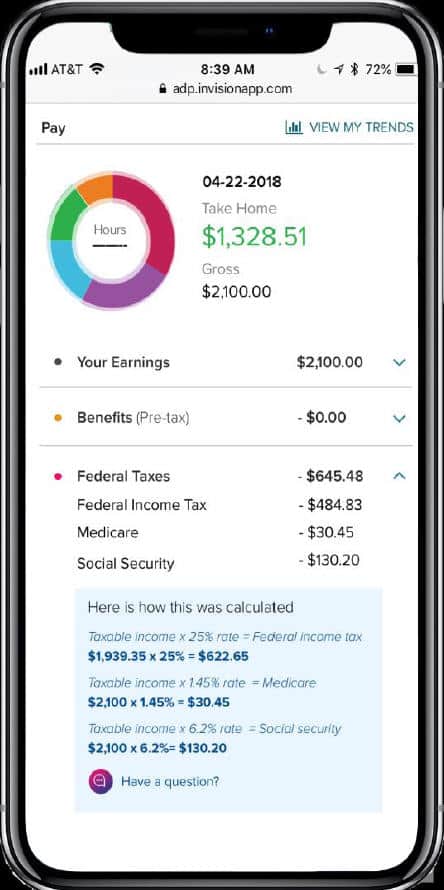

Under a keen escrow plan, you’ll be able to send in extra cash with every of month-to-month home loan money. Their financial commonly put that it currency on a keen escrow membership. If the possessions fees otherwise insurance debts is actually owed, the financial will use so it currency to expend her or him on the account.

This will be simpler. Although not all the home customer wishes an enthusiastic escrow plan. Certain need to pay their residence fees and you may insurance rates expenses on the their particular, arguing you to that they had rather have a lowered month-to-month homeloan payment or that they can make better accessibility their bucks than simply watching them attend a low-interest-impact membership addressed by the mortgage lenders.

“Making these money your self, you do have getting self-disciplined,” said Staci Titsworth, local conversion process director to own PNC Home loan into the Pittsburgh. “You must make sure that you actually perform kepted the money for the taxes and you can insurance policies. These are maybe not small bills. You ought not risk be blown away when the costs become. You dont want to feel scrambling to come up with $6,000 at the last-minute.”

The fresh new PITI algorithm

People never always read the parts that go to their month-to-month mortgage repayment. Titsworth and other mortgage gurus utilize the acronym PITI to explain it: If you have an enthusiastic escrow arrangement, your money each month visits pay off the mortgage loan’s prominent balance, attention, fees and insurance — otherwise, PITI.

Say your residence fees into 12 months try projected in the $six,000. In the event the yearly homeowners insurance can cost you $1,two hundred, possible shell out $100 each month, currency that financial again often put into your escrow account. This is why you are purchasing $600 even more monthly to fund your residence taxation and you can property owners insurance.

When your insurance expenses and you may possessions taxation is actually due, their financial dips in the escrow membership to expend him or her to own you. You do not do anything, but lead the desired dollars with every mortgage payment.

“There is comfort having escrow,” said Doug Leever, home loan conversion process director having Tropical Economic Borrowing Partnership inside the Miramar, Fla. “You don’t have to value putting that money aside.”

He’s got a time. Tax debts and you will insurance policies costs can also be sneak-up into property owners in the event the they’re not disciplined sufficient to pack out the fresh bucks must shelter these debts when you look at the seasons.

“There are no unexpected situations,” Leever told you. “There isn’t any, ‘Whoops, i forgot to store and place that money away.’ You don’t need some one having to scramble, having to put the commission to their credit card they get it out of the discounts.”

Certain lenders can even charge a fee to help you individuals who require to pay their house taxes and you will insurance rates bills on their own. Others want you to definitely consumers enter escrow arrangements in the event the its mortgage-to-worthy of percentages was 80 % or higher. So, if you owe take-out a mortgage having, state, $180,100000 towards the a property respected during the $190,000, chances are large that your particular bank will require you go into an escrow contract with them.

版权声明:本文由爱上教育原创。本文链接:http://biaobai.puaas.com/6646.html 转载请注明出处!